Schedule a Call Back

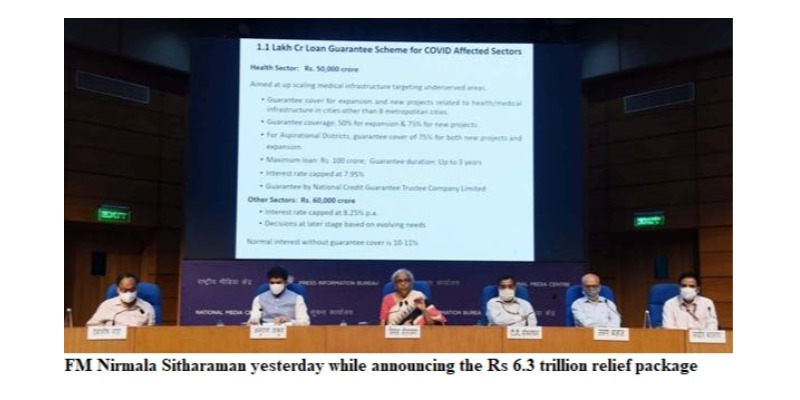

Indian govt announces Rs 6.3 trillion relief package to fight second Covid wave

Industry News

Industry News- Jun 29,21

Related Stories

Decoding the attempt of a liquidity boost to MSEs

Recently, certain amendments were introduced through the Finance Act 2023 (FA 2023) to enhance financial liquidity for Micro and Small Enterprises (MSE) by indirectly compelling their customers to p..

Read more

Hamza Arsiwala: AI & smart metering are changing the dynamics in power sector

In this interview with Manish Pant, Hamza Arsiwala, President of IEEMA, gives a sense of the paradigm shifts taking place in the country’s power sector.

Read more

Budgeting for growth?

The interim budget 2024-25, announced by Union Finance Minister Nirmala Sitharaman on February 1, 2024, has allocated Rs 11.11 trillion as capital expenditure (capex) for the next financial year –..

Read moreRelated Products

Anaerobic Adhesives

Parson Adhesives India Private Limited offers a wide range of anaerobic adhesives.

Speciality Adhesives & Emulsions

Sonal Adhesives Limited offers a wide range of speciality adhesives & emulsions.

Henkel Terostat Adhesive

Popatlal & Company offers a wide range of henkel terostat adhesive - Terostat MS 939.