Schedule a Call Back

Power transmission: Expanding networks till the last mile

Technical Articles

Technical Articles- Mar 01,18

Better pace of project implementation and stable attention from the government has made power transmission a new business zone and promising investment destination, says Nitika Sharma.

The transition which Indian power sector has seen over the past 4-5 years narrates its growth story quite well. From witnessing an escalated growth in thermal power installation – to building blocks for green energy development, from taking bold steps of all times in the form of UDAY –to setting goals of Power for All etc is what has changed the dynamics of Indian electricity sector in recent times.

With such transformation in picture, a makeover in the existing set up of power transmission segment is much needed. Transmission sector works as a foundation stone strongly holding the development of power generation & distribution segments. It goes unsaid that the growth of power sector is contingent to development of a robust and a non collapsible transmission network. Over the past decades, the total power capacity has witnessed commendable growth, with more than 330 GW of generation capacity currently installed in India. However, India’s peak load supply is close to 150 GW only, and aggravating this situation further is that some of India's power surplus regions do not have adequate power evacuation infrastructure which could alleviate the recurring supply shortages in other parts of the nation.

Significant efforts (in terms of providing smooth policy and regulatory framework along with massive investments) have been planned in the past for strengthening the power transmission infrastructure in country. But, continuous cases of congestion in the transmission lines witnessed in the recent past is a testimony of much more efforts are still required to pull up the transmission segment in India.

The issues related to generation and distribution sectors, rightfully, got due focus from policy makers and industry stakeholders. Transmission, which is the critical link of power supply with no fall back option, got down played due to multiple reasons. Despite of all the fall back, India was able to achieve ‘One Grid’. Commensurate with the generation capacity addition plans, need for a strong power transmission and distribution sector too exists.

However, the government seems to be positive in terms of roping in huge investments for making the development of the same to be in sync with the power generation segment. In 13th five year plan (FYP), investment of $ 40 billion is planned for power transmission sector with more focus is likely to remain on intra-state transmission infrastructure which was lagged in last FYPs. An extensive network of transmission lines has been developed in Indian over the years for evacuating power produced by different power generating stations and distributing the same to the customers.

Depending upon the quantum of power to be transmitted and distance involved, transmission lines of appropriate voltage levels are planned and laid. Presently, India boasts a power transmission network of 381761 circuit kilometers (ckt kms) as per the latest estimates (as on November 2017). Of this total network, the share of central transmission utility (CTU) stands to be 146005 ckt kms whereas the state transmission utilities (STUs) contributes approximately 2019144 ckt kms. However, the share of private transmission utilities (PTUs) is quite less when compared with STU’s and CTU’s but not insignificant. It is pertinent to note that from having almost zero presence, the private players have managed to open channels for them into India’s landlocked power transmission space and presently holds a transmission capacity of close to 26522 ckt kms.

In fact, the emphasis on grid reliability, push for renewable energy corridors and the recent policy reforms is making the sector more investment centric for the private players from erstwhile being a dry spell. Further, the planned investment of $ 3.5 billion in the green energy corridor by FY2022 and the proposed general transmission networks access would boost the business prospects for private players even more in coming years.

Key statistics and the growth story

During 12th FYP, the total transmission capacity of India stands to be 367851 ckt kms which witnessed a growth of close to 43% from the network length observed during 11th FYP. Of this total capacity, maximum growth was seen in the network additions at the voltage level of 400 kV. As, from a transmission capacity of 106819 ckt kms during 11th FYP, the same increased to a level of 157787 ckt kms during 12th FYP, that indicates an escalation of 50968 ckt kms. Further, from a period April 2017 to November 2017, the capacity addition of transmission network at 400 kV remains the highest – indicating an increase of 9160 ckt kms. At a voltage level of 200 kV, a decent addition of 27288 ckt kms was seen from 11th FYP to 12th FYP, which further increased to 2614 ckt kms during April 2017 to November 2017.

Talking about the transformation capacity, it should be noted that the same was observed to be 740,765 MVA during 12th FYP, which grew 80% of what seen during 11th FYP. Of this total transformation capacity observed in 12th FYP, contribution of intra region networks stands to be 437,762 MVA and accounts 59% of the cumulative transformation capacity of the country. Further, an addition of 50,805 MVA was seen in the transformation capacity during a period from April 2017 to November 2017, making the total capacity to reach 791,570 MVA as on November 2017.

Coming onto the contributions of Indian states in building up transmission network of the country, it should be noted that the northern region states holds a network of approximately 98106 ckt kms as on Dec 2017, which witnessed a growth of close to 4% from that observed during March 2017.

In the north, Uttar Pradesh and Rajasthan drive the transmission capacity holding a share of 36% and 37% respectively into the same.

Further, the northern states boasts a transformation capacity of close to 253,737 MVA as on December 2017 in which the cumulative share of Uttar Pradesh and Rajasthan stand to be approximately 65%. Also, in terms of substation’s count, it is significant to note that about 1,651 substations existed in the northern region as on December 2017, which witnessed a growth of 2% from the count observed during March 2017.

Moving towards the west, it can be seen that the transmission network in western region states stands to be 154426.9 ckt kms as on December 2017. Of this capacity, about 65232 ckt kms of the network length exists in Gujarat, whereas Madhya Pradesh contributes close to 36535.1 ckt kms of the network length. Maharashtra too hold a significant share of 41512.4 ckt kms in the total transmission capacity, whereas Chattisgarh accounts about 11147.4 ckt kms of network length as on December 2017.

Further, the western states boasts a transformation capacity of close to 281387.5 MVA as on December 2017 in which the cumulative share of Gujarat and Maharashtra stand to be approximately 76%. Also, in terms of transformer’s count, it is significant to note that about 2831 transformers existed in the western region as on December 2017, which witnessed a growth of 0.46% from the count observed during March 2017.

' In the eastern region, it can be seen that the transmission network in western region states stands to be 42594.8 ckt kms as on December 2017. Of this capacity, about 13294.5 ckt kms of the network length exists in West Bengal, whereas Bihar contributes close to 12877.8 ckt kms of the network length. Jharkhand too hold a significant share of 3348 ckt kms in the total transmission capacity, whereas Odisha accounts about 13074.4 ckt kms of network length as on December 2017. Further, the eastern states boast a transformation capacity of close to 65967.5 MVA as on December 2017.

Down in the south, about 5808 ckt kms of addition was seen in the transmission capacity from April 2017 to December 2017. Of this total addition, contribution of Andhra Pradesh stands to be 881 ckt kms, contribution of Telangana stands to be 1989 ckt kms, Karnataka holds a share of 671 ckt kms and Tamil Nadu added nearly 2267 ckt kms of network during April 2017 to December 2017. Further, it is anticipated an expansion of 16238 ckt.kms to be seen in the existing transmission network of southern region till FY2022 as per the current scenario.

Power transmission: A bright future

The power transmission sector in India has witnessed a significant growth over the tenure of past 3-4 years, but this is not it. The recent reformations witnessed in the power sector has definitely pulled up the performance of the power transmission sector in the country but has also raised the pressures for delivering high in upcoming years.

Various schemes announced by the government such as Deendayal Upadhaya Gram Jyoti Yojana, Integrated Power Development Scheme, Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya Scheme) - crux of all lies into better and uninterrupted supply of power in the country, which in turns require a strong transmission network. Further, the push for green energy corridor, plans for developing energy storage market, targeting 100% electrification of rural - remote areas and the anticipated increase in the power demand intimates the need for a stable grid and better transmission infra set up in the country.

In fact, to cater all this it has been estimated that there would a requirement of additional 100000 ckt kms of transmission lines by FY 2022. Also, it is anticipated that by FY 2022 an additional power transformation capacity of 200000 MVA will be needed at the voltage of 220 kV & above, attracting an investment to the tune of approximately $ 5 billion. Further, it is important to note that an overall amount of Rs 2.6 lakhs crore is projected to make an entry into the account books of power transmission industry from the government’s side with contribution of state transmission utilities hovering around 62%.

With so far planning and achievements the projected developments in the power transmission sector seems quite well placed. Having said that, encouraging more PPP into the sector will be vital to meet the huge investment & capacity enhancement target in India’s transmission segment. Therefore, more initiatives should be taken by the government to saddle the pace of private participation into the same.

Nitika Sharma is a Senior Consultant at Enincon Consulting Llp working for the research and advisory division catering to the energy and infrastructure practice. She has worked on many advisory projects specifically into developing the growth and product strategies for clients. Her key contributions were into determining consumer segmentation, market penetration and market forecasting. Enincon is a leading provider of research, analytics and advisory services in the energy and infrastructure space to different stakeholders across the globe. For details, contact Ruchika Motwani, Manager – Business Development of Enincon Consulting LLP, on email: ruchika.motwani@enincon.com

Key facts

States down in the south plans to increase the grid fed power capacity by 12.5 GW from 2017 to 2020

States from west to north plans to increase the grid fed power capacity to 20 GW

Related Stories

Revolutionising HVAC efficiency with renewable energy and low-carbon materials

HVAC systems, crucial for maintaining indoor comfort, have long relied on fossil fuels, raising concerns about environmental impact and energy efficiency. Even so, a transformative moment, aptly cal..

Read more

Boehlerit: Know-how in cutting of tubes

In order to cover the different machining steps, Boehlerit has, over the decades, as the industry’s leading tool supplier, created the market’s most comprehensive product range, now also includi..

Read more

Increasing automation drives servo motors demand

The market for servo motors was significantly influenced by the growing use of automation across a number of industries, including manufacturing, automotive, electronics, and packaging, says Adroit ..

Read moreRelated Products

Power Conversion Systems

POM Systems & Services Pvt Ltd offers a wide range of

PCS power conversion systems energy storage.

Hot Water Generators

Transparent Energy Systems Private Limited offers a wide range of Hot water generators - Aquawarm Superplus.

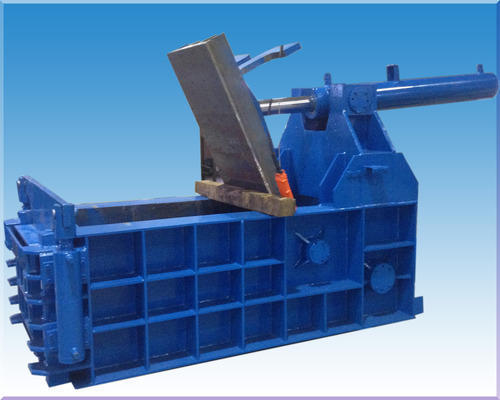

Scrap Baling Press

Fluid Power Machines offers hydraulic scrap baling press. Read more