Schedule a Call Back

Budget 2012-13: CII Calls for Comprehensive Package for MSMEs

Industry News

Industry News- Feb 24,12

The Confederation of Indian Industry (CII) has called for a comprehensive package for Micro, Small and Medium Enterprises to unshackle their growth potential. As part of its pre-Budget recommendations to the Government, CII, where the majority of members are from this industry segment, outlined a 16-point agenda for the MSME sector.

According to Mr Chandrajit Banerjee, Director General, CII, the MSME segment, which employs more than 59 million persons and contributes approx 40% to manufacturing output and to the exports, can truly emerge as a growth driver for the economy if the key issues are addressed in a proactive manner.

CII has strongly recommended that the new Direct Tax Code, which is slated to offer investment-linked tax incentives, should instead link tax rates to employment. This approach, espoused by many countries, would create more jobs as also help MSME, which by definition have limited capital investments and are employment-intensive.

The vexatious issue of Delayed Payments to MSME can be dealt with by applying interest on payments beyond the 45 days stipulated in the MSME Development Act, suggested CII, adding that Facilitation Councils formed under the Act should have greater authority. Mandatory Factoring could also address the issue, said CII.

In its statement, CII came out strongly in favour of the implementation of the Public Procurement Policy, recommending that Large Industry could be entitled to tax benefits if transactions with MSME are completed within 45 days. Public Procurement Policy mandates 20% purchase of goods and services from MSME for public sector enterprises.

Phase-out of tax benefits under Sec 10A and 10B of the Income Tax Act under STPI scheme should be re-examined as their proposed withdrawal would adversely affect over 5000 small software and IT services, advocated the industry association.

CII also called for raising the low threshold for Service Tax exemption, which is currently at Rs 10 lakh. It recommended raising this ceiling to Rs 25 lakh.

A key recommendation in the CII statement relates to ICT adoption by MSMEs. CII has suggested that 100% depreciation once in a block of three financial years for annual investment of Rs 25 lakh in IT equipment and software would greatly enhance technology adaptation by the sector. It would also enlarge the market for such products.

According to the CII package, creation of different kinds of funds is needed to promote different aspects of MSME. A venture capital fund of Rs 10,000 crore under public-private partnership mode could promote first generation entrepreneurs and greenfield investments. A Technology Fund could also be instituted for incentivising climate-friendly technologies. In order to improve overall access to funds for MSME, a working group of RBI and credit rating agencies should work out a uniform credit rating format and processes, suggested CII.

Among other measures, CII has recommended availability of industrial infrastructure through a corporation that would rent out facilities to MSME; promoting competition among segments of stock markets for SME; and strong thrust on skill development by increased facilities in industrial training institutes.

Related Products

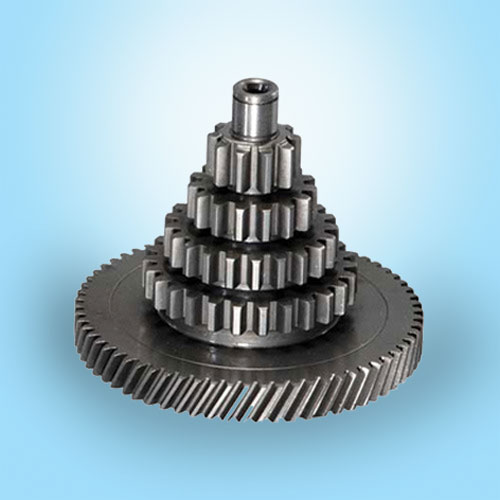

Cluster Gears

Trishla

Gear Industries is engaged in manufacture and supply of a wide range of cluster

gears.

Servo Drives, Fully Digital

Bristol

Industrial Electronics offers optimum quality, fully digital servo drives.