Schedule a Call Back

Auto Components: Accelerated Growth

Technical Articles

Technical Articles- Jun 10,15

India is rapidly emerging as a global hub for sourcing auto components using a combination of strategies and proximity to key automotive markets like the ASEAN, Japan, Korea and Europe.

The Indian auto industry boasts of some superlative figures. India is the largest manufacturer of tractors in the world. It is the second largest manufacturer of two-wheelers and buses, the fifth manufacturer of heavy trucks and the sixth manufacturer of cars. Together, this means the country is the seventh-largest automotive producer in the world with an average annual production of 17.5 million vehicles, and by the end of this year is estimated to be the fourth largest automotive market by volume.

Well, that also means India has a thriving auto components industry to feed this huge requirement of vehicles, as logic, volumes, logistics and excise duty structure ensures that local manufacturing is the most sensible route in this segment. In fact it was the advent of Suzuki as partner for the Maruti small car in the 1980s that actually set the ball rolling for the growth of the auto components industry in India. It was the first time that the concept of a dedicated vendor base was actually implemented with the company taking the lead to establish joint ventures for manufacturing key components and systems, e.g., the JBM Group of Companies, Krishna Maruti and several others. With the onset of liberalisation in the 1990s, as more global automakers including major American, European and Asian companies came to India, the Indian auto components industry got a further fillip. This helped the domestic auto component manufacturers to get exposure to the technological advances being made all over the world. Some of these manufacturers, encouraged and prompted by the automakers, entered into collaboration with well-known global OEMs to emerge as component suppliers not just to their Indian operations but also to their parent companies.

For the record, the Indian auto component industry has historically fared well, and the revenues have risen from US$ 26.5 billion in FY08 to US$ 40.6 billion in FY13 - a CAGR of 8.9 per cent. But according to the estimates of the Auto Components Manufacturers Association of India (ACMA), the apex body, the Indian auto component industry is expected to register a turnover of US$ 66 billion by FY 15-16 with the likelihood to touch US$ 115 billion by FY 20-21, depending on favourable conditions. In addition, industry exports are projected to reach US$ 12 billion by FY 15-16 and add up to US$ 30 billion by FY 20-21. For the record, India's exports of auto components increased at a CAGR of 19.6 per cent to US$ 9.3 billion during FY08-13.

But the fact remains that India is still a net importer of auto components, though the gap is now narrowing. While exports increased to USD 10.2 billion from USD 9.7 billion in FY13, imports declined 6.3 per cent - from USD 13.7 billion to USD 12.8 billion. With the Indian automobile market expanding, manufacturers are now making an effort on increasing localisation, thus creating more opportunities for Tier1 companies to fill in the gaps. For example, German luxury carmaker BMW is now concentrating on sourcing parts from at least seven India-based auto parts makers in order to increase the percentage of indigenisation of its cars for purely economic reasons, though it also fits into the 'Make in India' campaign.

Uno Minda, a major Indian automotive supplier and Kosei Aluminum Co Ltd, a Japanese leading alloy wheel manufacturer recently entered into a joint venture agreement to manufacture and sell alloy wheels in India. While both companies have existing plants in India operating in Chennai, since 2010, the new project, named, Minda Kosei Aluminum Wheel Pvt Ltd, will be established in Bawal, Haryana. The JV company is to engage in the development, manufacturing and sales of aluminium alloy wheels for major OE car manufacturers. The start of production is planned from February 2016 with a capacity of 60,000 units per month (1st Phase).

In another development, major auto component supplier Motherson Sumi Systems Ltd (MSSL), through its subsidiary Samvardhana Motherson Automotive Systems Group BV (SMRPBV), has received a significant set of orders from Germany's Daimler for the supply of a range of exterior and interior systems for several future Mercedes-Benz vehicle generations. Motherson Sumi estimates these orders to generate sales revenues of approximately Rs 15,400 crore (Euro 2.2 billion approximately) over its lifetime and expected to commence from calendar year 2018. The company will put up new plants - one each in Europe and USA for this, to be close the Daimler facilities. So this is an example of Indian companies going global.

Pune-based Honeywell Transportation Systems, is now providing its industry leading variable-geometry, diesel turbocharger technology to Volkswagen for its new 1.5L TDI diesel engine designed and developed in India to meet the unique needs of the local automotive market in the newest versions of Volkswagen and SKODA. Volkswagen selected Honeywell for its more than 20 years of experience developing its variable nozzle technology (VNT) benefiting diesel engines with improved responsiveness, performance and fuel economy. Honeywell's global technology platform and its established design, application, engineering and manufacturing operations in India enabled collaboration between personnel in Europe and India. The result was a turbo application benefiting the new 1.5L TDI diesel engine from Volkswagen on the Polo, the Vento, and the Rapid.

According to ACMA Director General Winnie Mehta, ACMA has signed with the Confederation of Indian Industry a Memorandum of Understanding to adopt a cluster approach to enhancing the productivity and quality of automotive components manufactured in India. The MoU provides for creating a new programme for cluster-based structure for engineers and technicians employed with ACMA members who will get guidance from representatives of CII member companies for implementation of best practices.

But there is a serious mismatch between the prospects of the industry and the willingness of the companies in this sector to invest in R&D. "It is a known fact that Indian component manufacturers do not spend significant amounts on R&D. In Europe, 4-5 per cent of net sales are ploughed back into R&D while in India, this stands at less than 1 per cent. ACMA has been encouraging manufacturers to invest in R&D so that we stay on par with the other countries. A lot is being done to increase awareness about the importance of R&D. We have also requested the government for an interest subvention scheme to encourage investment in this area," says Mehta.

The industry currently accounts for almost seven per cent of India's gross domestic product (GDP) and employs about 19 million people, both directly and indirectly. The ever-increasing development in infrastructure, big domestic market, increasing purchasing power and stable government framework have made India a favourable destination for investment, as per the vision of Automotive Mission Plan (AMP) 2006-016.

While the Auto Policy 2002 paved the way for automatic approval for 100% foreign equity investment in auto components manufacturing facilities, manufacturing and imports in this sector are exempt from licensing and approvals. AMP 2006-2016 has come a long way in ensuring the growth of this sector in the global market. It is expected that the automobile sector's contribution to the GDP will double reaching a turnover of US$ 145 billion in 2016 due to the government's special focus on exports of small cars, multi-utility vehicles (MUVs), two and three-wheelers and auto components. Also, the deregulation of FDI in this sector has helped foreign companies to invest huge amounts in India. AMP 2006-16 has provision for setting up a technology modernisation fund focusing on small and medium enterprises; and establishment of automotive training institutes and auto design centres, special auto parks and virtual SEZs for auto components. There is this assured growth in years to come.

Related Products

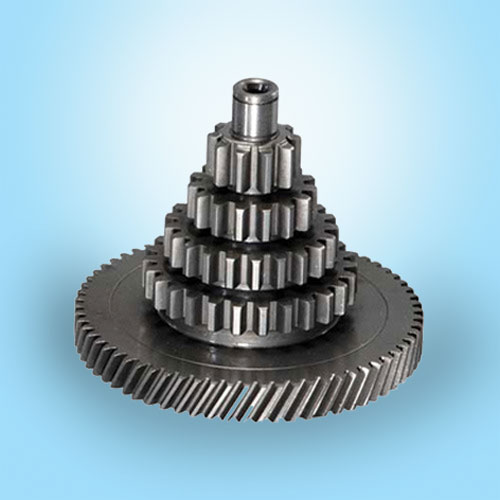

Cluster Gears

Trishla

Gear Industries is engaged in manufacture and supply of a wide range of cluster

gears.

Servo Drives, Fully Digital

Bristol

Industrial Electronics offers optimum quality, fully digital servo drives.