Schedule a Call Back

Indian solar market witness healthy competition in H1 of 2018

Industry News

Industry News- Nov 01,18

| Companies | Leaders in |

|

Adani

|

Top utility-scale project developer by installed capacity |

| CleanMax Solar | Top rooftop installer |

| Sterling & Wilson | Top utility-scale EPC player |

| ABB | Top inventer supplier |

| ZnShine Solar | Top solar module supplier |

| L&T Construction |

Top solar tracker supplier

|

Source: Mercom India Market Share Leaderboard

Related Stories

Tarak Mehta to leave ABB after 26 years of service

Tarak joined ABB in 1998 and has since then held a number of positions of increasing responsibility in the United States, Sweden and Switzerland. He will leave ABB at the end of July this year

Read more

ABB India achieves 'water positivity' in half of its manufacturing sites

Potential to recharge 1,19,373 cu.m. rainwater from the site (excluding rooftop) runoff at ABB Peenya

Read more

nasscom CoE teams up with Capgemini for Smart Manufacturing in India

The program aimed at capability building for manufacturing leaders & SMEs, providing step-by-step guidance on accelerating the adoption of digital technologies at plants to improve operational effic..

Read moreRelated Products

Power Conversion Systems

POM Systems & Services Pvt Ltd offers a wide range of

PCS power conversion systems energy storage.

Hot Water Generators

Transparent Energy Systems Private Limited offers a wide range of Hot water generators - Aquawarm Superplus.

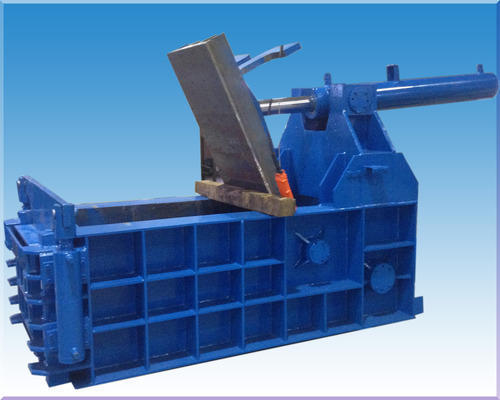

Scrap Baling Press

Fluid Power Machines offers hydraulic scrap baling press. Read more