Schedule a Call Back

Domestic steel makers struggle with sluggish demand growth: ICRA

Industry News

Industry News- Oct 22,19

Related Stories

India: A responsible leader in the evolving manufacturing sector

India's growing manufacturing sector, coupled with its commitment to sustainability, presents a unique opportunity for the country to become a global leader in responsible manufacturing, says Marc J..

Read more

IPF turns smart with SME

In 1972-73, the India's economy grew by about 2 per cent compared to previous year with industrial sector registering a growth of only 4.5 per cent while agriculture production declining by 1.7 per ..

Read more

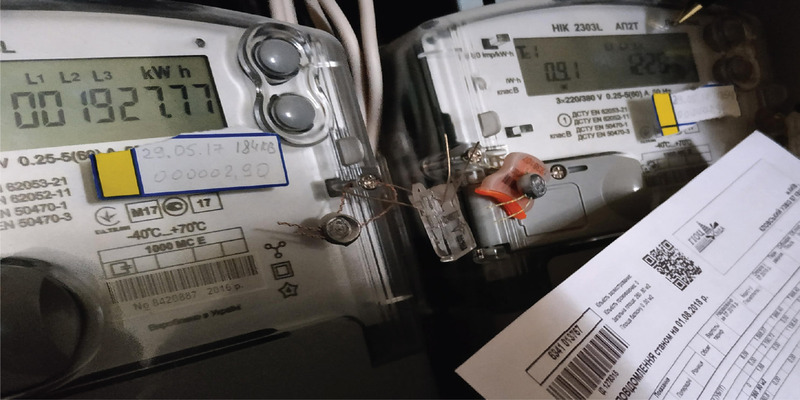

Smart meter installations set to surge, but 2025 target may elude govt: ICRA Report

The ratings agency stated that the allocation of smart meters by state distribution utilities or companies (discoms) is projected to rise to 222 million in the near-to-medium term, compared to the 9..

Read moreRelated Products

Stainless Steel

Shalco Industries Pvt Ltd offers alloy stainless steel.

Stainless Steel Pulverizers

Sree Valsa Engineering Company offers a wide range of stainless-steel pulverisers.

Metal Expansion Joints

RMS Corporation offers a wide range of metal expansion joints with fixed flanges.