Contact:

Madan Sabnavis

Chief Economist

madan.sabnavis@careratings.com

91-22-68374433

Author

Ashish K Nainan

Deputy Manager- Industry Insights

ashish.nainan@careratings.com

91-022-6837 434

Mradul Mishra (Media Contact)

mradul.mishra@careratings.com

+91-22-6837 4424

Disclaimer:This report is prepared by CARE Ratings Ltd. CARE Ratings has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain. However, neither the accuracy nor completeness of information contained in this report is guaranteed. CARE Ratings is not responsible for any errors or omissions in analysis / inferences / views or for results obtained from the use of information contained in this report and especially states that CARE Ratings has no financial liability whatsoever to the user of this report

Half-yearly Update: Cargo volume and Passenger numbers:

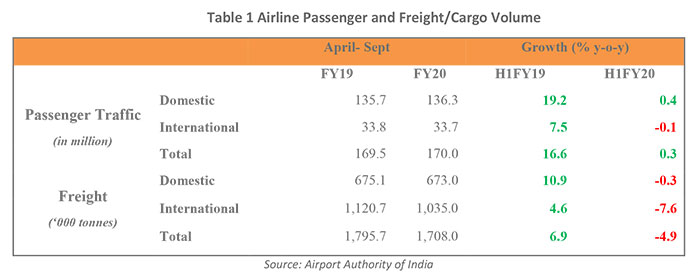

First-half of FY20 witnessed subdued activity in terms of cargo volumes and passenger traffic. Airline traffic and port traffic managed to report low growth whereas railway freight recorded 0.5% de-growth during the first half of the current fiscal.

- Airline passenger traffic recorded marginal growth (Less than 1%) International passenger traffic recorded marginal negative growth and cargo volumes recorded 7.6% decline during April-Sept 2019. Grounding of operations by a major airline in the month of April has led to decline in international passenger and cargo traffic during the first six months.

- Major ports recorded 1.5% growth during H1FY20 vs 5.2% growth during the corresponding period in the previous year. Global economic slowdown and trade-war has impacted trade volumes globally in addition to weak domestic trade volume.

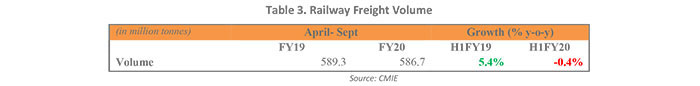

- Railway freight volumes recorded 0.5% de-growth in cargo handled in terms of tonnage. This is a considerable decline from 5.4% growth recorded in H1-FY19.

- The volume and passenger numbers across major transport modes have remained weak during FY20. The numbers relate well with subdued economic activity – both domestic and foreign trade.

Airlines

- Domestic passenger traffic numbers recorded marginal growth (Less than 1%) whereas international passenger traffic declined marginally during H1-FY20 y-o-y. Total passenger traffic grew by 0.3% during the period vs 16.6% growth during the corresponding period in the previous year.

- Decline in international passenger and freight can be attributed to Jet Airways discontinuing operations which led to disruption on international routes. Passenger traffic growth has also been impacted by

- International Cargo volume recorded decline of 7.9% during H1FY20 and domestic cargo recorded 0.3% de-growth vs. H1FY19. This can be attributed to factors like weak global macros and trade war apart from disruption in services across few key routes.

Major Ports

- The 12 major ports recorded 1.5% increase in cargo volume handled during H1-FY20 y-o-y vs 5.2% recorded during the corresponding period in the previous year.

- Growth was mainly on account of increased coking coal volume (15.2%), iron-ore incl. pellets (~35%) and finished fertilizers. Coking coal and iron-ore together account for ~15% of the total cargo handled by the major ports

- Fertilizer (incl. raw) volumes recorded a 16.9% decline, followed by thermal coal which recorded 13.2% decline and miscellaneous cargo which recorded 10.3% decline.

- Petroleum and its products (POL) which accounts for ~33% of India’s trade volume, recorded 2.1% growth in volume to 117.1 million tonnes during H1FY20.

Railways

- Total cargo volume handled by railways declined by 0.5% during H1-FY20 y-o-y vs 5.4% growth recorded during the corresponding period in the previous year. A host of factors which includes prolonged monsoon and economic slowdown has led to freight volumes being impacted.

- Among major cargo segments, Coal volume declined by 1.1% during H1-FY20 and the decline number bears significance as it accounts for ~45-50% of railways freight volume.

- Cement volumes declined by 10% during H1FY20 y-o-y to 52 million tonnes. Slowdown in construction activity due to prolonged monsoons has been one of the factors impacting cement demand during the first half of FY20.

- Steel and Iron (incl. pig iron, iron-ore & finished steel) accounted for over ~20% of the freight volume and recorded 6% growth in cargo volume handled by railways

- Fertilizer volume witnessed a marginal decline. Petroleum products and container cargo recorded marginal growth during the year

CARE Ratings Limited

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022. CIN: L67190MH1993PLC071691

Tel: +91-22-6754 3456 I Fax: +91-22-6754 3457

E-mail: care@careratings.com | Website: www.careratings.com

Follow us on