Contact:

+91-22- 6837 4433

Mradul Mishra (Media Contact)

mradul.mishra@careratings.com

+91-22-6837 4424

Disclaimer:This report is prepared by CARE Ratings Ltd. CARE Ratings has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain. However, neither the accuracy nor completeness of information contained in this report is guaranteed. CARE Ratings is not responsible for any errors or omissions in analysis / inferences / views or for results obtained from the use of information contained in this report and especially states that CARE Ratings has no financial liability whatsoever to the user of this report

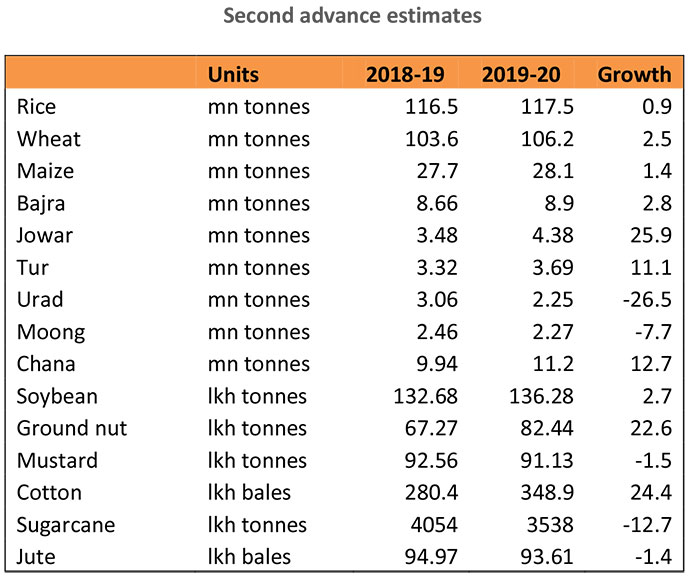

The second advance estimates of agricultural production presents a very positive picture for the sector for FY20 which should also feed into the GDP growth numbers for the year. The estimates point to higher production for most of the product groups – both kharif and rabi. The table below provides information on the estimated production numbers for some of the major crops

As these crops along with horticulture account for around 56% of GVA in the agriculture sector, there should be an upward push for growth numbers for the year. As can be seen, with the exception of moong, urad, sugarcane, jute and mustard, production of all other crops is expected to be higher this year. Foodgrains production, which includes cereals and pulses, would reach an all-time high of 292 mn tonnes.

The rabi sowing data so far has been positive with total area under cultivation being 662 lkh hectares as against 605 lkh hectares last year as on 31st January. In case of all the three major crops wheat, chana and mustard area under cultivation has been very satisfactory with that of wheat being higher by over 30 lkh hectares

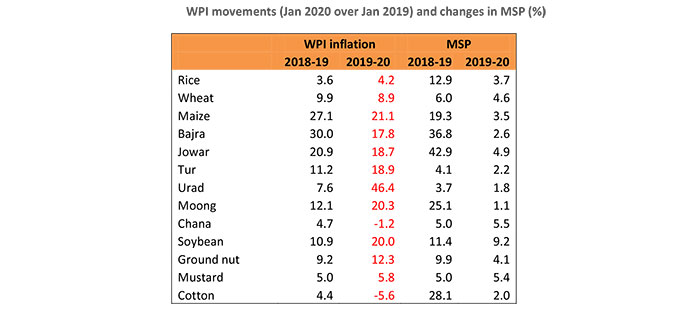

An interesting aspect of the farm production numbers expected is that notwithstanding a very good harvest in these crops WPI inflation has tended to be high for several products.

B. Sectoral Deployment of Credit: MSMEs

- The price inflation for products in the pulses basket has been mixed. In case of tur inflation was high even though production was higher and can be attributed to higher demand conditions. Also while production has increased by 11.1% this year to 3.69 mn tonnes, the production levels are still substantially lower than 4.87 mn tonnes and 4.29 mn tonnes respectively in 2016-17 and 2917-18. In 2018-19 production had fallen sharply by around 23%. Therefore, carryover stock has also been lower which added to supply shortfalls in the current year

- In case of urad and moong inflation has been high and corresponds to lower expected production this year.

- Price inflation for chana has been negative this year so far which corresponds with higher expected production.

- In case of rice and wheat notwithstanding higher production this year, inflation has been of a higher order compared with 2018-19 with that of wheat being 8.9%. The increase in MSP can be partly responsible for this increase in prices though has been of a modest scale this year. In fact retail inflation for non-PDS rice and wheat was 4.2% and 7.1% respectively which would reflect higher income received by farmers even after adjusting for higher cost of cultivation with input prices being higher.

- In case of coarse cereals like maize, bajra and jowar inflation has been high mainly due to higher demand especially from the food products sector as well as production levels being lower than that in 2017-18 as 2018- 19 was the year when production fell. The recovery in 2019-20 has only partly made up for the deficit and with lower carry forward stocks had resulted in demand-supply mismatch.

- Higher soybean price inflation can be attributed to the reference MSP being higher this year by 9.2% over and above 11.4% last year. This was an incentive provided to boost output which had fallen in 2017-18 by 22 lkh tonnes. Main producing state Madhya Pradesh has been experimenting with the scheme of compensating farmers for the difference between the MSP and market prices since last year when prices came down due to higher supplies.

- Groundnut production has been very volatile over the years and while output has increased in 2019-20, it would still be lower than the level of 92.5 lkh tonnes witnessed in 2017-18.

- Cotton prices have been coming down due to very sharp increase in production from 280.4 lkh bales to 348.9 lkh bales this year.

Concluding remarks

Agricultural production is a very important aspect of the economy as it has a direct contribution of around 8% to aggregate GVA (excluding livestock and forestry). The share of agri related products in IIP is around 11-12%. Further, farmers’ income is a critical part of rural spending that is said to contribute to demand post kharif harvest which carries on till January and resumes again in March –May when the rabi crop is harvested. Therefore price received is also important along with overall production as they determine the income of farmers. However high food inflation impacts farmers’ consumption of discretionary goods and while they could receive higher prices for their product like say rice and wheat, could also be paying higher prices for other food items like pulses.

Food inflation has been a concern of late especially so as headline CPI inflation has been above the 6% mark for two months. While prices of horticulture products would tend to come down those of cereals and pulses would continue to be elevated till March. Therefore, while higher food inflation can be beneficial in net terms to farmers of those crops which have witnessed higher prices it also comes in the way of monetary policy and hence attains significance.

The numbers presented here also indicate that linking production with price inflation is no longer a straight forward exercise as other factors like demand, carry-forward stocks, MSP play an effective role in driving prices.

CARE Ratings Limited

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022. CIN: L67190MH1993PLC071691

Tel: +91-22-6754 3456 I Fax: +91-22-6754 3457

E-mail: care@careratings.com | Website: www.careratings.com

Follow us on