Contact:

Saikat Roy

Director

saikat.roy@careratings.com

91-22- 6754 3404

Sushant Hede

Associate Economist

sushant.hede@careratings.com

+91-22-6837 4348

Mradul Mishra (Media Contact)

mradul.mishra@careratings.com

+91-22-6837 4424

Disclaimer:This report is prepared by CARE Ratings Ltd. CARE Ratings has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain. However, neither the accuracy nor completeness of information contained in this report is guaranteed. CARE Ratings is not responsible for any errors or omissions in analysis / inferences / views or for results obtained from the use of information contained in this report and especially states that CARE Ratings has no financial liability whatsoever to the user of this report

The monthly SME roundup provides an update on the capital marke movement in the broad SME indices, upcoming IPOs in the SME space and key developments in the sector. The report also takes a closer look at the credit growth in the MSMEs.

Key Highlights

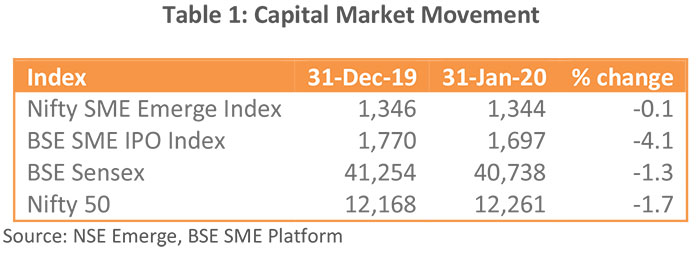

- There was a broad-based decline across all 4 indices during the month of January, 2020. Broad indices including Sensex and Nifty ended lower by 1.3% and 1.7% respectively during the month. Both the SME indices also ended lower with Nifty SME Emerge Index registering a decline of 0.1% while BSE SME IPO index recording a steep decline of 4.1%.

- The various budget announcements for the MSME sector:

- Introduction of a scheme to provide subordinate debt for entrepreneurs of MSMEs which will be counted as quasi-equity and will be fully guaranteed through Credit Guarantee Trust for Medium and Small Entrepreneurs.

- Consideration of extending the window for restructuring of bank loans availed by MSMEs till 31 March 2021 has been put in front of the RBI

- Enabling NBFCs to extend invoice financing to the MSMEs through TReDS which will enhance their economic and financial sustainability

- App-based invoice financing loans product to be launched soon to obviate the problem of delayed payments of MSME

- The turnover limit for businesses to get their books of accounts audited by an accountant has been raised from Rs 1 crores to Rs 5 crore which would benefit the MSME segment.

- The total allocation made to the Ministry of Micro, Small and Medium Enterprises in FY21 stood at Rs 7572 crs, 8% higher from the revised estimates of FY20(RE)

A. Capital Market Movement

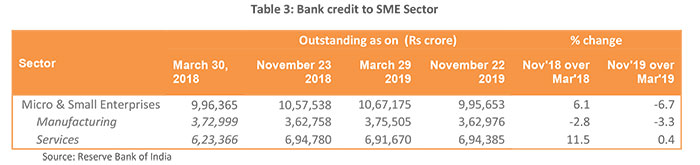

B. Sectoral Deployment of Credit: MSMEs

The bank credit to MSMEs has grown at a CAGR of 15% in the last decade. Services sector accounts for over 60% of the total bank credit disbursed to MSME sector and thus has been driving the overall MSME credit. As of November 22 , 2019, the outstanding credit disbursed to MSME segment totalled Rs 10.57 lkh crs. The incremental bank credit to MSME segment has witnessed a contraction of 0.9% during March- November 2019 compared with negligible growth in the comparable period a year ago. The incremental credit to manufacturing segment contracted by 3.3% during the period while the incremental credit to services sector witnessed marginal growth of 0.4%.

C. Key Developments

MSME Ministry seeks stakeholders views on proposed National Technology Mission

Following preparation of a draft discussion paper on “Promoting Technology Adoption by MSMEs – Mission Document” by the ministry, it has sought comments from the stakeholders for the same. This mission focusses on activities modelled around seven different pillars including emerging technology, human capital, access to finance, infrastructure, market place, policy and governance, and knowledge creation.

The MSME Ministry approves NIT Srinagar as Business Incubator

The Project Monitoring and Advisory Committee (PMAC) committee of Ministry of Micro, Small and Medium Enterprises (MSME) has approved the proposal of NIT Srinagar to recognize it as a Business Incubator. This is with an objective to promote and support untapped creativity of individuals besides promote adoption of latest technologies in manufacturing as well as knowledge-based innovative MSMEs (ventures) that seek the validation of their ideas at the proof of concept level

The MSME Ministry has partnered with the Government of Telangana for BioAsia 2020

MSME Ministry partners with Telangana for BioAsia, a highly regarded platform in the life science sector to bring about cutting edge, innovative and technologically oriented MSMEs from this sector. The event will be hosted in Hyderabad during February 17 to 19 and will add impetus to the growth of the MSME sector.

CARE Ratings Limited

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022. CIN: L67190MH1993PLC071691

Tel: +91-22-6754 3456 I Fax: +91-22-6754 3457

E-mail: care@careratings.com | Website: www.careratings.com

Follow us on